Knowledge base

Browse support articles

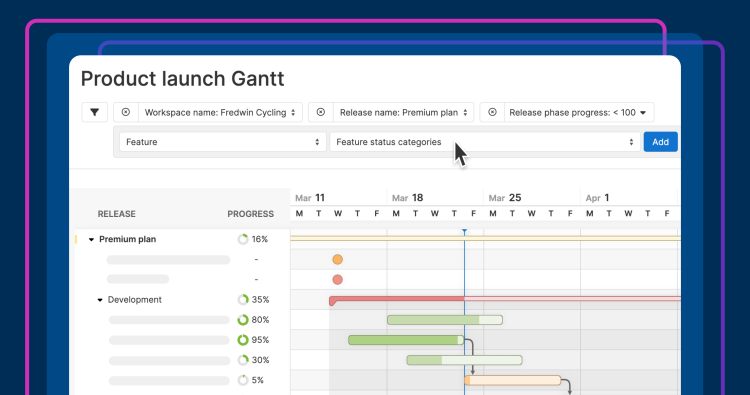

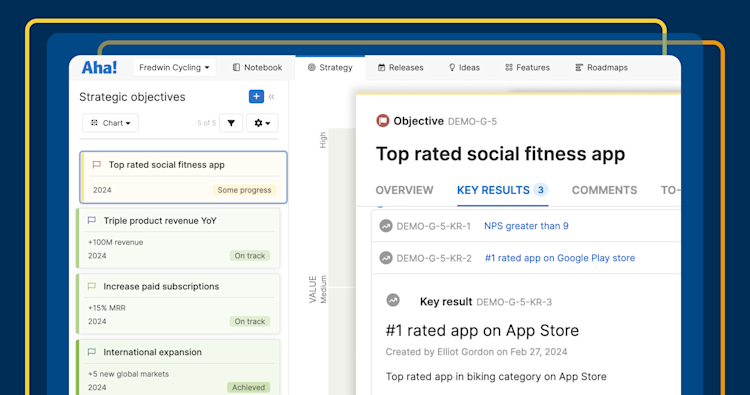

Set product plans based on strategy, resources, and what customers value most

Engage with customers to understand their feedback and analyze trends

Drive innovation with whiteboards that purpose-built for product builders

Share all of your product documents with customers and colleagues in one place

Link technical work to the product roadmap and foster healthy development teams

Recent product launches

Explore popular topics

Get advice from product experts

Our Product Success team is staffed with product managers who love to work with customers. We respond within two hours and would be happy to demo what the software can do.